Target-Date Mutual Funds – What are they and should you use them?

Cash Reserve in Retirement

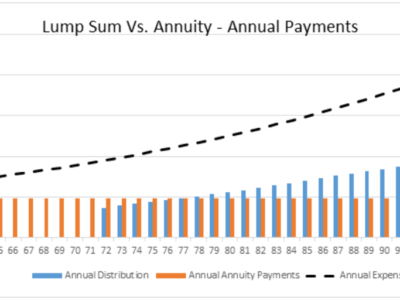

Pension Lump-Sum vs. Annuity: Which to Choose?

Inflation and Retirement

Oxy Pension: Lump-Sum or Annuity – Which is Better?

How To Select A Financial Advisor

Sequence of Returns Risk

What Are Stock Splits?

Small Business Retirement Plans

How do you pick the most appropriate retirement plan for your business as well as your employees? As a small-business owner, figuring out retirement choices can be a little intimidating.The SECURE Act and CARES Act may complicate the decision. There are three main types of retirement plans for small businesses: SIMPLE-IRAs, SEP-IRAs, and 401(k)s. Read […]